SYNOPSIS ON DISCUSSION PAPER ON REVISED REGULATORY FRAMEWORK FOR NBFCs – A SCALE-BASED APPROACH

With the aim to protect financial stability and ensuring all Non-Banking Financial Companies (NBFCs) to grow and operate with ease, the Reserve Bank of India (RBI) has proposed to introduce a scale-based regulatory framework for NBFC to segregate the larger entities and regulate them with the stricter norms.

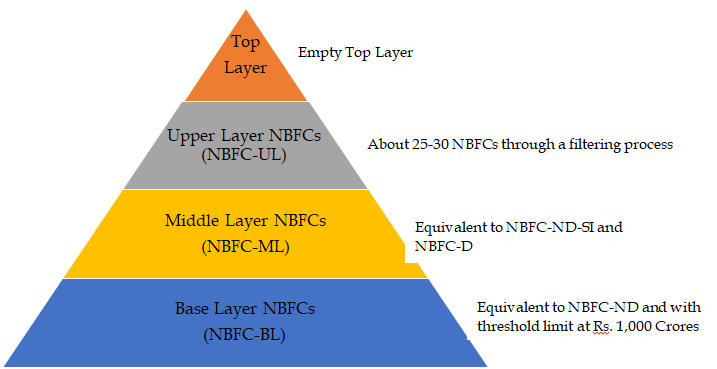

In the discussion paper, the RBI has proposed that the regulatory framework of NBFCs shall be based on a four-layered structure – Base Layer (NBFC-BL), Middle Layer (NBFC-ML), Upper Layer (NBFC-UL) and Top Layer.

BASE LAYER (NBFC-BL)

- The Base Layer (NBFC-BL) will comprise of NBFCs currently classified as Non-Systematically Important NBFCs (NBFC-NDs).

- The Base Layer will have NBFCs with an asset size of upto Rs. 1,000 Crores. The extant regulatory framework for NBFC-NDs will now be applicable to Base Layer NBFCs.

- The minimum NOF for base layer NBFCs would be Rs. 20 Crores. The existing NBFCs would be given a time-period to comply with the revised NOF requirement and new NBFCs will have to comply with the NOF norms immediately on the issue of instructions.

- The extant NPA classification norm of 180 days will be harmonized to 90 days.

MIDDLE LAYER (NBFC-ML)

- The Middle Layer shall comprise of all non-deposit taking NBFCs classified currently as NBFC-ND-SI and all deposit taking NBFCs.

- This layer will exclude NBFCs which have been identified to be included in the Upper Layer. Further, NBFC-HFCs, IFCs, IDFs, SPDs and CICs, irrespective of their asset size, will be covered in this layer

- The Middle Layer (NBFC-ML) will have stricter rules than existing.

- The extant regulatory framework applicable for NBFC-NDSI (Non-Deposit Systematically Important) will be applicable to Middle Layer NBFCs.

- The exposure ceilings would be levied on the NBFCs for overall lending and investment

- NBFCs will have to abide by Board approved Internal Capital Adequacy Process (ICAAP).

- The Statutory Auditors/firm after completion of continuous audit tenure of three years, shall not be eligible for re-appointment as Statutory Auditors of the same NBFC for a period of six years (two tenures).

- The Chief Compliance Officer shall be appointed to ensure effective compliance culture and strong compliance risk management.

- Key managerial personnel (whole time employee in the nature of CEO, CFO, CS and WTD) will not hold any office (including directorships) in any other NBFC-ML or NBFC-UL.

- An independent director shall not be on the board of more than two NBFCs (NBFC-ML and NBFC-UL) in total.

- Corporate Governance Disclosures are also proposed to be made applicable to NBFC-ML.

- Ceiling of Rs. 1 Crore to be fixed per individual for any NBFC for IPO financing

- Regulatory restrictions would be levied on NBFCs on lending.

- Guidelines on sale of stressed assets by NBFCs will be modified on similar lines as that for banks.

- NBFCs with 10 and more branches shall mandatorily be required to adopt Core Banking Solution.

UPPER LAYER (NBFC-UL)

- The Upper Layer shall consist of only those NBFCs which are specifically identified as systemically significant among NBFCs. Only 25-30 NBFCs can be placed in the Upper Layer.

- The Upper Layer will have NBFCs which have large potential of systemic spill-over of risks and have the ability to impact financial stability.

- The Upper Layer will have to abide by stricter norms/regulations like bank.

- In order to enhance the quality of regulatory capital, the Capital Equity Tier 1 capital to be 9% within the Tier 1 capital.

- Leverage requirement will be levied on NBFC-UL.

- The differential standard asset provisioning will be prescribed for NBFC-UL on lines of banks.

- In view of higher systematic risk posed by NBFC-UL, the Large Exposure Framework (LEF) can be extended to NBFC-UL alongwith a transition time for implementation.

- Additional Corporate Governance regulations would be applicable on NBFC-UL like ensuring that the group structure is not complex and opaque.

TOP LAYER

- Top Layer is supposed to remain empty.

- The layer can get populated in case the Reserve Bank takes a view that there has been unsustainable increase in the systemic risk spill-overs from specific NBFCs in the Upper Layer

To View Discussion Paper Click Here